![]()

As we look forward to 2023, we aim for the consolidation of our positioning in our current markets and preparing for further expansion in the GCC region while keeping the balance between growth and profitability.

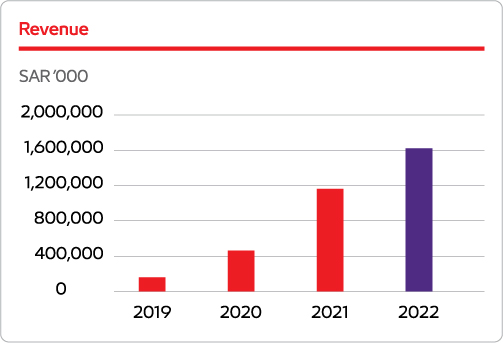

The year 2022 was marked by significant strides in the progress of the Group. Gathering momentum from our IPO, our Group expanded its operations to around 90 cities in the Kingdom, invested in several business verticals, enhanced its technical capabilities, and improved customer experience and engagement while also acquiring new businesses and diversifying our portfolio. These developments, in turn, helped us move into a new phase in our trajectory by establishing our identity, visibility, and market presence of the Group platforms offering differentiated technology-enabled logistics solutions for an increasingly diverse mercha nt and customer base. We remain on track to achieve our strategic objective of above-market growth, with a record net revenue of SAR 1,602.5 Mn in 2022 and a gross profit that was 46.3% higher than in 2021.

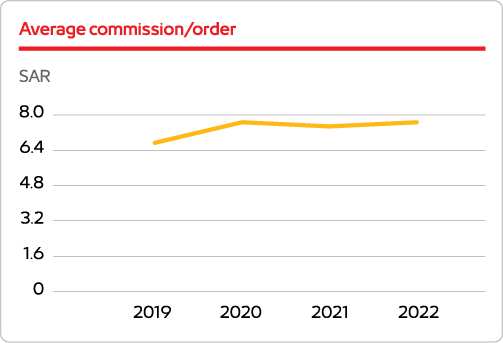

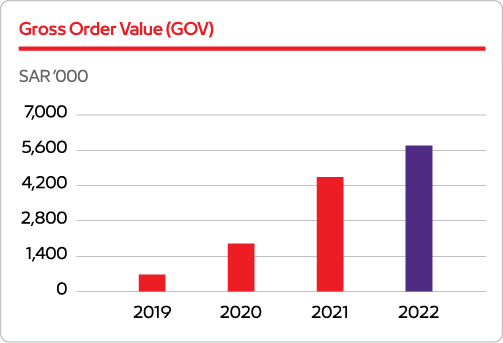

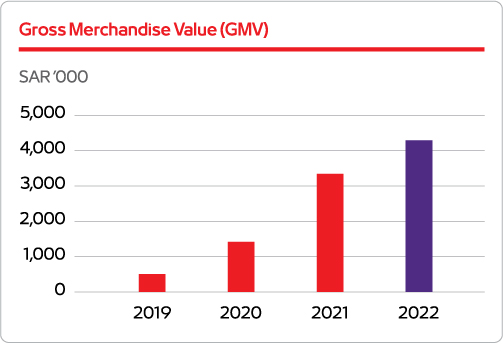

The Group achieved strong top line growth in 2022, demonstrating the soundness and potential of our fundamental business model and our efforts to scale and expand. The Group saw a 34% increase in Gross Revenue, driven by higher delivery fees (up 32.9% YoY), commission income (up 37.3% YoY), and other revenues (up 29.8% YoY). Gross Merchandise Value (GMV) grew from SAR 3.3 Bn in 2021 to SAR 4.3 Bn in 2022, a rise of 28.4% (with Gross Order Value (GOV) increasing from SAR 4.5 Bn to SAR 5.8 Bn, a growth of 29%). The primary driver of this growth was a 33.8% increase in the number of orders – from 51.6 Mn orders in 2021 to 69.0 Mn orders in 2022 – supported by a 35.3% rise in average number of users. The monthly average orders per user reached 4.8 orders in 2022, compared to 4.7 orders last year, while the Average Order Value (AOV) decreased from SAR 64.8 to SAR 62.2 over the same period. Additionally, merchant numbers grew from 7,061 to 10,648 restaurants, and the average take rate increased to 12.5% from 11.6%.

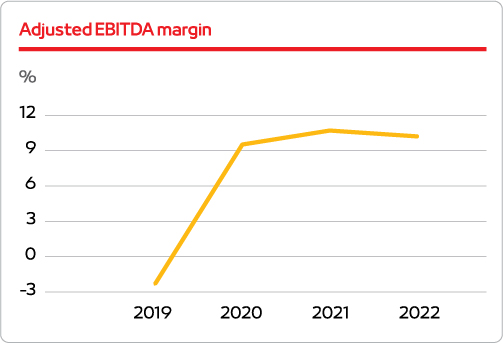

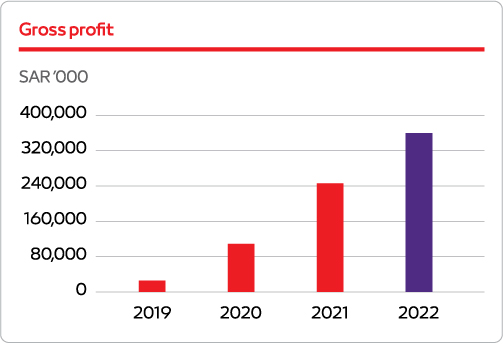

These strong indicators of business progress were correspondingly reflected in a positive increase in net revenue, which amounted to SAR 1,602.5 Mn, an increase of 38.2% compared to the previous year. Gross profit for the year 2022 reached SAR 359.2 Mn, an increase of 46.3% compared to 2021. Adjusted earnings before interest, taxes, depreciation, and amortization (adj. EBITDA) increased by 32.8%, reaching SAR 167.1 Mn compared to SAR 125.3 Mn for last year, thereby representing 10% of gross revenues at a steady rate for 2022 and 2021. This is a direct identification of our ability to generate cash flows as we scale. Furthermore, it is impressive to note that this growth was accomplished despite the costs associated with the international expansion in Bahrain and Kuwait during 2022 as well as investments in developing the direct commerce platforms (PIK, BLU Store), which will have a material contribution to revenues starting in 2023.

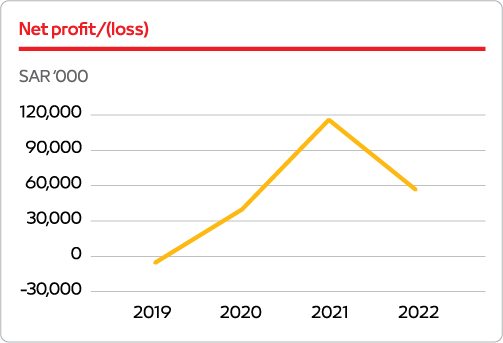

The profit of the Group for 2022, however, decreased by 52%, reaching SAR 56.5 Mn compared to SAR 116.7 Mn

in 2021. The reasons for this decrease were primarily due to non-recurring expenses in the logistics segment as discussed below. Also, it is worth noting that Zakat for 2022 increased markedly, reaching SAR 28.3 Mn due to the addition of proceeds from the Initial Public Offering to the Zakat base.

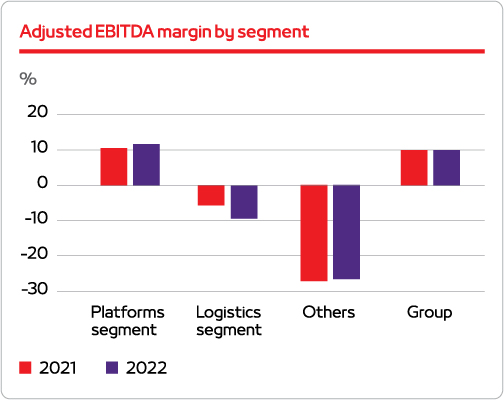

The Group’s strong performance is primarily attributable to the strides of the delivery platform segment. Adj. EBITDA for the segment in 2022 was SAR 194.5 Mn (representing 11.7% of gross revenue and 3.4% of the GOV), an increase of 47% in 2022 compared to SAR 132.2 Mn (10.6% of Gross Revenue and 2.9% of the GOV) in 2021. Profit for the segment increased by 56% over 2021 to reach SAR 180.4 Mn. Progress in top line and bottom line growth for the segment is due to geographical expansion and growth in order volumes and the corresponding improvements in cost efficiencies and economies of scale effects.

The Group started implementing its own fleet for logistical services in 2022 in response to governmental requirements. The Group’s fleet currently secures a significant portion of orders for its delivery platforms, allowing the Group to be one of the key players in the last-mile delivery market, but the logistics segment faced persistent difficulties throughout the year. Despite the increase in segment revenues by 180.4% compared to last year, Adj. EBITDA declined to SAR -29.2 Mn and the loss for the year was SAR 123.8 Mn, compared to a loss of SAR 6.4 Mn in 2021. This loss is primarily the result of non-recurring expenses representing the value of salaries, wages and benefits for drivers for the period before the completion of the necessary procedures to join the operating team amounting to SAR 79.5 Mn and the low productivity of new drivers during the learning phase, which experienced several unexpected delays.

Following the successful completion of the IPO, the Group ended 2022 in a markedly transformed financial position. Total assets increased from SAR 494 Mn to SAR 1.4 Bn, with cash and cash equivalents at SAR 902.7 Mn at the end of 2022, compared to SAR 391.7 Mn at the end of 2021. Total equity rose from SAR 188.3 Mn to over SAR 1 Bn. No dividend has been declared or paid in the year under review, as the Group is focused on substantial reinvestments into the business to ensure long term growth and shareholder returns.

As we look forward to 2023, we aim for the consolidation of our positioning in our current markets and preparing for further expansion in the GCC region while keeping the balance between growth and profitability. We will ensure the allocation of funds needed for investment in parallel with non-financial strategic measures to boost the organic and inorganic growth of the Group. Similarly, the Group’s focus on investing in ESG, creating social value, and contributing to the environment will be another crucial area that will be given the utmost priority moving forward. With the demonstrated potential and resilience of our business model and strategy, our focus on our mission to exceed stakeholder expectations and with the determination of the talented and highly skilled people working for the Group, we are confident about the future and the growth potential of Jahez.

Heni Abdul Hakeem Mohamed Jallouli

Chief Financial Officer