Jahez has developed an Enterprise Risk Management Framework which is adapted from relevant frameworks including ISO 31000 (Risk Management – guidelines), and COSO (Enterprise Risk Management — Integrated Framework), in a manner consistent with local practices and requirements issued by the local government agencies. It is also integrated into the Jahez reporting structure and all that it does to meet compliance. Jahez is monitoring the identified risks against established metrics and through management’s response to manage, mitigate, or accept risk.

While developing the risk appetite framework and embedding risk appetite, the Company:

- Sets the strategic plan and objectives as well as the risk strategy and risk capacity.

- Articulates and cascades risk appetite statements and limits.

- Monitors and reports risk profile versus appetite.

- Controls and corrects the risk profile should it deviate from appetite and reassess the risk appetite and its strategy in the light of changes in the business, competitive or control environments.

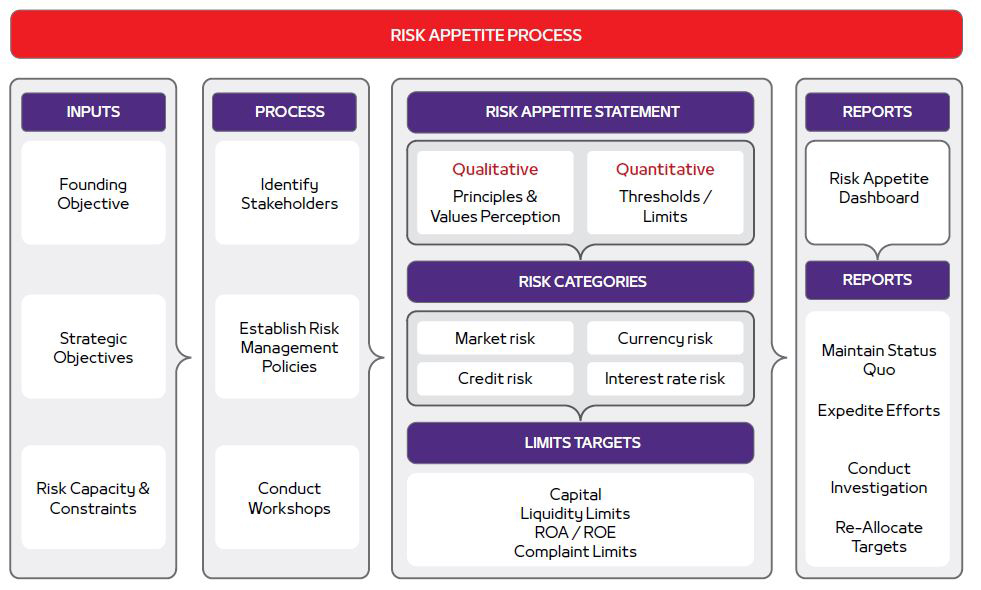

The below diagram illustrates the components of the risk appetite framework.

The risk appetite of the Company is determined reflecting and balancing goals for growth, return and risk.

Risk Management Policy

The Group has worked on defining the control and risk management processes following the best international practices. The Board of Directors of Jahez and its Senior Management rely on these principles in the development of the Company’s strategy and decision-making process. The Management then undertakes planning, organizing and directing processes in order to ensure reasonable assurance that the Company’s objectives can be achieved, while ensuring that the relevant risks are within the Company’s risk appetite.

The Board of Directors is responsible for overseeing the risk management and internal control system and reviewing its effectiveness. The system is designed to determine and manage the risk of failure, and not to eliminate it, in order to achieve the strategic objectives of the company and provide reasonable assurance, not absolute, against errors or gross loss.

The Board also assumes general responsibility for determining the nature and extent of the main risks, which it may bear to achieve its strategic objectives (risk appetite) and ensure management of these risks effectively. The Board has authorized the responsibility for reviewing the effectiveness of internal control systems and risk management methodology in the company to the Audit Committee.

Risk management governance

The Board has authorized the responsibility for reviewing the effectiveness of internal control systems and the risk management methodology of the Company to the Audit Committee. The Board of Directors of Jahez also oversees the risk management process through the Audit Committee which is responsible for reviewing the Risk Management Framework to ensure that it is still sound and identifies all potential risk areas. In addition, the Committee reviews the adequacy of policies and processes designed and carried out by the Management for the purpose of managing specific risks and submitting annual reports to the Board of Directors and the General Assembly.

The Audit Committee also conducts regular reviews of applicable internal control systems in the Company, including all related tasks, policies and procedures to ensure that they are still adequate and sufficient to identify and reduce risks. In the case of transactions and contracts involving a high degree of complexity, we work with advisers to minimize their dangers.

The Executive Management is responsible for determining the nature of risk management. The Management at all levels is responsible for identifying, as appropriate, the risks related to scope of their work and management. The Company’s functional tasks also support the implementation and facilitation of the risk management process.

Risk management activities

In the year 2022, Jahez hired a third-party consultant to establish the Enterprise Risk Management (ERM) and conducted an Enterprise Risk Assessment exercise and the identified critical risks were associated with the following categories: Governance, Strategic, Technology and Information Security, Financial, Operational and Commercial, Regulatory and Compliance, Reputational, Environmental, Health, Safety and Security. Risk Management started this year with assessing the risk in the inherent level (before considering the control in place) and the risk in the residual level (after considering the control in place) and developed a mitigation plan of the residual risks.

Jahez focused on raising awareness of risk management in all departments of the company and its subsidiaries and defining roles and responsibilities. We at Jahez prioritize risks to keep the focus on the most relevant risks. Risks are assessed on the basis of potential impact and probability analysis, and related actions are implemented to manage or mitigate risks.

Risk factors in the company

The Group is subjected to various financial risks due to its activities including market risk (including currency risk, fair value and cash flows of interest rate risk), credit risk, and liquidity risk. The Group’s overall risk management program focuses on the unpredictability of financial markets and seeks to minimize potential adverse effects on the financial performance of the Group.

The Board of Directors is responsible for risk management. Financial instruments recognized in the consolidated statement of financial position include cash and cash equivalents, trade receivables, due from/to related parties, investments at FVTPL, other current assets, trade payables, accrued expenses, other current liabilities, collections due to customers, and lease liabilities. The particular recognition methods adopted are disclosed in the individual policy statements associated with each item. Financial asset and liability are offset, and net amounts are reported in the consolidated financial statements, when the Group has a legally enforceable right to set off the recognized amounts and intends either to settle on a net basis, or to realize the assets and liabilities simultaneously.

Market risk

Market risk is the risk that changes in market prices such as foreign exchange rates, profit rates and equity prices that will affect the Group’s income or the value of its holdings of financial instruments. The objective of market risk management is to manage and control market risk exposures within acceptable parameters while optimising the return.

Currency risk

Currency risk is the risk that the value of a financial instrument will fluctuate due to changes in foreign exchange rates. The Group’s transactions are principally in Saudi Riyals and US Dollars. The Saudi Riyal is pegged to the US Dollar. The management closely and continuously monitors the exchange rate fluctuations.

Interest rate risk

Interest rate risks are the exposures to various risks associated with the effect of fluctuations in the prevailing interest rates on the Group’s financial positions and cash flow. The Group has no significant interest rate risk.

Credit risk

Credit risk is the risk that a counterparty will not meet its obligations under a financial instrument or customer contract, leading to a financial loss. The Group is exposed to credit risk from trade receivables, cash and cash equivalents, prepayments, and other receivables, and due from related parties.

| 31 December 2022 | 31 December 2021 | |

| Trade receivables | 22,759,260 | 6,674,849 |

| Prepaid expenses and other receivables | 82,184,561 | 36,636,636 |

| Due from related parties | 17,130 | 237,484 |

| Cash and cash equivalents | 902,685,742 | 391,688,002 |

| Deposits with financial institutions | 200,000,000 | _ |

| Investments at FVTPL | 22,728,737 | 19,837,032 |

| Total | 1,230,375,430 | 455,074,003 |

Liquidity risk

Liquidity risk is the risk that the Group will encounter difficulty in raising funds to meet commitments associated with financial instruments. Liquidity risk may result from the inability to sell a financial asset quickly at an amount close to its fair value. Liquidity risk is managed by monitoring on a regular basis that sufficient funds are available to meet any future commitments. The Board of Directors closely and continuously monitors the liquidity risk by performing regular review of available funds, present and future commitments, operating and capital expenditure. Moreover, the Group monitors the actual cash flows and seeks to match the maturity dates with its financial assets and liabilities.

The Group seeks continuously to comply with its legal obligations, including any relating to its financing agreements.

Achievements in 2022

The year 2022 was marked by several accomplishments by the Group, which were made possible due to its financial strength, competitive advantages, and advanced digital infrastructure. These achievements have added solid pillars to the implementation of the Group’s strategy and plans for expansion and growth with confidence.

One of the most notable achievements of the Group in 2022 was its successful entry into the parallel market (Nomu). This move gave the Group a foundation to launch strongly towards achieving its ambitious strategy of expansion and growth. The IPO on (Nomu) was remarkable, with notable practices and outstanding investor interaction. This success has given the Group a solid platform to build on as it continues to pursue its growth objectives.

- The Group also maintained its market share with healthy growth, while aiming to optimize exploited opportunities. This achievement is a testament to the Group‘s ability to navigate challenging market conditions and capitalize on opportunities.

- The Group also acquired the Marn Business Information Technology Company, which will help merchants build their unique ecosystems by developing systems for business owners through various digital solutions that work in conjunction with different service providers and partnerships. This acquisition is in line with the Company’s desire to add more verticals to its activities and continue its growth.

- Based on its in-depth study of market trends and business environment trends, coupled with the extensive experience of its management and operational staff supported by a highly developed digital infrastructure, the Group reached 9 operating locations in 5 different cities through Co Kitchen. This showed a promising future in the field of cloud kitchens, and the Company is now operating its branches in Riyadh, Qassim, Hail, Khobar, and Dammam. This achievement is a testament to the Group’s ability to adapt to changing market conditions and capitalize on emerging opportunities.

- Expansion and growth by establishing new branches of Jahez throughout the Kingdom of Saudi Arabia exceeding 90 cities, reaching over 90% of the population, and establishing more strategic partnerships with local , regional and international brands active in the restaurants and kitchens sector. This expansion has been a key part of our strategy to reach more customers and provide them with our services. The Group has also launched its international operations in Bahrain and Kuwait.

2022 Challenges

In 2022, the Group faced several challenges that could have potentially hindered its growth and success. One of the most significant challenges was the introduction of government regulations and laws aimed at regulating the market. These regulations required all companies operating in the transportation sector to register their drivers on a centralized platform and document their data comprehensively. This posed a significant challenge to the company’s operational ability to meet its ambitions and plans to expand in this field.

However, the Group was able to turn this challenge into an opportunity for success. It implemented its own fleet of drivers through its logistic company, Logi, which helped cover the company’s needs and expand its business base. This allowed the Group to extend its services to fulfill the requirements and needs of other market. By doing so, the Group was able to adapt to the new regulations while still expanding its operations and increasing its market share.

Another challenge the Group faced was the rapid digital and technological development in the transportation sector. To face this challenge, the Group invested heavily in developing its highly advanced and flexible digital infrastructure, relying on the latest tools. The Group also supported this infrastructure with a highly skilled team. This gave the company a permanent ability to develop according to the highest standards of quality and advanced efficiency in this field, enabling it to implement its diversified operational and investment strategies and plans with high efficiency.

Overall, the Group‘s resilience, robust work strategy, strength of its operational, digital, and advanced technology structure, and the efficiency of its managerial and logistical teams allowed it to turn these challenges into opportunities for success in 2022.

2023 Objectives

The Group has implemented an ambitious future business strategy based on its significant achievements and successes during the past year 2022.

In 2023, the Group aims to achieve several important goals to further enhance its market position and profitability.

Firstly, the Group plans to boost its efforts to expand its promising investment vessels, ensuring more profitable returns for all shareholders and partners. To achieve this goal, the Group will provide all necessary support and assistance to its subsidiaries, including Logi for logistical support services, Inc. PIK for q-commerce, Co. Kitchen for cloud kitchens, and the newly established BLU Store for sportswear and fitness equipment.

Secondly, the Group aims to increase its market penetration in the Western and Eastern regions of the Kingdom of Saudi Arabia, as well as other newly entered cities.

Thirdly, the Group will focus on optimizing its operations in new markets in Bahrain and Kuwait, which it recently joined. This move is in line with the Group‘s expansion plans and aims to reach a larger user base and consolidate its position in the territory.

Finally, the Group will continue its inorganic growth through mergers and acquisitions, using this as a method to enter new markets and strengthen its position in current markets.

Overall, the Group‘s 2023 objectives demonstrate its commitment to expanding its market position, increasing profitability, and enhancing its operational efficiency.